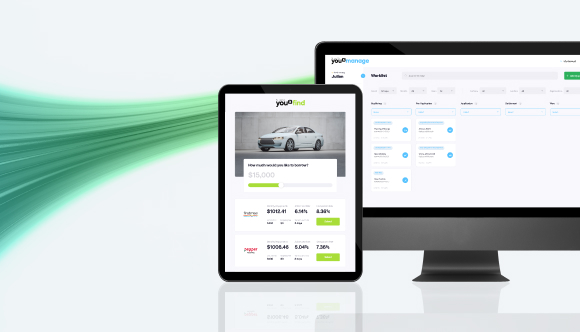

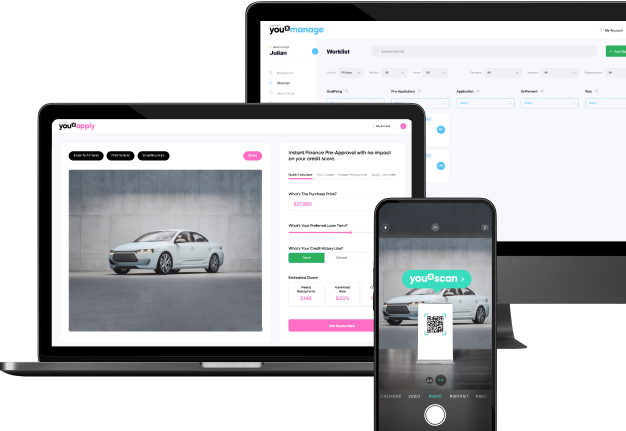

We know your brokerage business lives and breathes on its leads. And a hot lead only stays hot for so long. Which is why youX has built a brokerage product stack that drives more qualified lead volume, more revenue streams and helps you to submit more deals more quickly, accurately and safely.

The youX Broker product stack brings you more

From lead generation to deal management

youXManage users can electronically send Credit Quotes and Credit Guides directly to customers for e-signing. As well as smart generation of fact find, credit proposal and preliminary assessment documents. All of which are time / date stamped, verified by the user and stored within youXManage.

Ensuring NCCP compliance, the above is seamlessly integrated into our consumer application process, so that deals cannot progress to submission until mandatory information is captured and compliance documents are held. With a audit trail supported by a detailed system event log for every deal.

Privacy documents are stored in youXManage and can be emailed directly to the customer for e-signing. Credit bureau reports are also available for request with smart design ensuring these cannot be requested without a signed privacy and customer information including drivers licence or identification.

youXManage enables bank statements to be collected across 3, 6 or 12 month periods. Statement data is then available to verify the client’s expenses and income.

youXManage users have the ability to capture traditional drivers licence and physical verification methods with data storage in Manage, against the client. The user also has access to a digital customer verification process to satisfy their AML / KYC requirements for verifications that are not in person.

The youXManage system consists of a PHP/mysql-based processing platform, cloud-hosted and split across dedicated instances for individual clients. This is supported by numerous Node.js/MongoDB microservices which are also cloud-hosted.

The system is functionally assured at a number of levels, broadly split into the following categories; for security reasons some details are omitted.

Standard software development procedures are followed between development teams, with all software version-controlled and updates released only after functional assurance, via our local deployment process. Automated change detection and process monitoring on the server are also enforced as a failsafe measure to ensure correctness and completeness of new features and updates.

Functional testing on both the front and backend is currently performed via a suite of predefined scenarios, first in our dedicated development environment and then via user acceptance testing in our UAT environment.

Backups of the system state at points of known functionality are regularly updated and maintained, with rollback via version-controlled system state.

Server access is controlled at a broad level via IP whitelists, then via a tiered user permissions scheme and finally 2-Factor Authentication. Audits are regularly performed on IP access and on recent logins.

Site access is controlled via SSL and the database access is designed to prevent malicious attacks such as SQL injection. Database snapshots are regularly synchronised and available for immediate restoration in the event of error or attack.

Individual components and server resources are monitored with automated (predictive) alerts the team.

System performance is regularly assured against known benchmarks, with code changes verified to ensure that they improve or maintain performance requirements.

Connected to more than 80 lender partners

Learn MoreHear from our happy clients

I want to...

POWERFUL PRODUCTS FOR GROWTH

youX delivers powerful asset finance technology and fulfilment products designed for multi-level business growth; including: enterprise, SME and start-up. Helping OEM manufacturers, dealers, brokers and lenders to better service their customers’ asset finance needs more quickly, safely and accurately than ever before. With unique product features that increase sales, while reducing the cost to service your customers. Welcome to youX.

BRANDSAFE PARTNER PROMISE

Brandsafe is a core youX value and our ‘closed loop’ partner promise is as much about data security, as it is the youX way of doing business. Inspiring our 11,500+ dealer and broker users, along with 80+ accredited lenders to trust us with $7.4 Billion of finance opportunities every single year.

As a B2B champion, youX exists to support your brand. Delivering tailored product solutions with best-in-class experiences, aligning to your commercial objectives. Making you look great and your bottom line even better. And because youX strives purely for its partners, your client list will safely stay your own. No unsolicited contact, ever.

youX places a strong emphasis on data security and ensures that the data and information processed through their products are protected, including but not limited to:

It’s important to note that while youX takes significant measures to secure data, it’s also essential for your business to follow best practices in data protection. This includes implementing secure access controls, user authentication measures, and internal data security protocols.

FASTER, EASIER, MORE ACCURATE ASSET FINANCE

The youX technology and fulfilment product stack is flexibly built and seamlessly connected to help partners grow with faster, safer, more accurate asset finance. Typical objectives of our audiences include:

DIVERSE LENDING PANEL

youX products support a truly comprehensive range of asset finance options, across a diverse lending panel. Which means your customers can easily find the right loan for their needs, whether they’re online, in your office or on your forecourt.

And whenever you need extra help, youXLodge Success Gurus are on hand. From in-depth asset finance scenario support to simply covering any lender accreditations you don’t have, drawing on youX’s 80+ lenders. Making it easier than ever to find finance a home.

DIVERSE ASSET TYPES

So whatever assets your customers are buying, youX has you and your customers covered:

Personal finance: In addition to commercial financing, youX also supports personal asset finance. This includes loans for personal vehicles, leisure assets, and other personal-use assets

SELL MORE, REDUCE THE COST TO SERVICE YOUR CUSTOMERS

youX delivers powerful asset finance technology and fulfilment products designed for OEM manufacturer business growth. The youX product stack is flexibly built and seamlessly connected to help your business with a range of commercial objectives, including, but not limited to:

Overall, youX technology and fulfilment products can help to support a healthier dealer network, with deeper finance penetration and faster conversions for the long term health of the OEM manufacturer.

DIVERSE ASSET TYPES & LENDING PANEL

youX products support a truly comprehensive range of asset finance options, so whatever assets your dealers are selling, youX has you, your dealers and their customers covered:

youX products also support a diverse lending panel. Which means your customers can easily find the right loan for their needs, whether they’re online, in your dealers’ office or on the dealers’ forecourt.

And whenever you or your dealers need extra help, youXLodge Success Gurus are on hand. From in-depth asset finance scenario support to simply covering any lender accreditations you don’t have, drawing on youX’s 80+ lenders. Making it easier than ever to find finance a home.

SEAMLESSLY CONNECTED, AGNOSTICALLY FLEXIBLE

youX technology products are designed to be seamlessly connected, yet agnostically flexible, allowing for compatibility with almost any existing systems and infrastructure, including:

We recommend discussing your specific requirements and infrastructure with us during the initial requirements discussion. This will allow us to provide the right solution and compatibility guidance.

BRANDSAFE PARTNER PROMISE

youX places a strong emphasis on data security and ensures that the data and information processed through their products are protected, including but not limited to:

It’s important to note that while youX takes significant measures to secure data, it’s also essential for your business to follow best practices in data protection. This includes implementing secure access controls, user authentication measures, and internal data security protocols.

SUCCESS (GURUS) BUILT IN

youX strongly believes that onboarding is just the start of the journey and provides comprehensive support and assistance not just throughout the onboarding and implementation, but also ongoing aftercare stages. And it all starts and ends with youXLodge, your Success Gurus. Here’s an overview of some of the support services you can expect:

youX is dedicated to providing comprehensive support and assistance throughout the entire journey, from onboarding to ongoing usage. With Lodge Success Gurus at your disposal to ensure full value realisation across technology products and asset finance fulfilment.

TAILORED PRODUCTS, WITH TAILORED PRICING

Speak to youX today to discuss your specific requirements, and we’ll recommend a product stack that meets your commercial objectives, with a pricing structure to match the recommendation.

Pricing details may vary depending on factors such as the scope of services, customisation requirements, and the specific needs of your business.

SELL MORE, REDUCE THE COST TO SERVICE YOUR CUSTOMERS

youX delivers powerful asset finance technology and fulfilment products designed for dealer business growth. The youX product stack is flexibly built and seamlessly connected to help your business with a range of commercial objectives, including, but not limited to:

Overall, youX technology and fulfilment products can help to support commercially stronger dealerships, with deeper finance penetration and faster conversions.

DIVERSE ASSET TYPES & LENDING PANEL

youX products support a truly comprehensive range of asset finance options, so whatever assets your dealership sells, youX has you and your customers covered:

youX products also support a diverse lending panel. Which means you and your customers can easily find the right loan for their needs, whether they’re online, in your office or on the forecourt.

And whenever you need extra help, youXLodge Success Gurus are on hand. From in-depth asset finance scenario support to simply covering any lender accreditations you don’t have, drawing on youX’s 80+ lenders. Making it easier than ever to find finance a home.

SEAMLESSLY CONNECTED, AGNOSTICALLY FLEXIBLE

youX technology products are designed to be seamlessly connected, yet agnostically flexible, allowing for compatibility with almost any existing systems and infrastructure.

We recommend discussing your specific requirements and infrastructure with us during the initial requirements discussion. This will allow us to provide the right solution and compatibility guidance.

BRANDSAFE PARTNER PROMISE

youX places a strong emphasis on data security and ensures that the data and information processed through their products are protected, including but not limited to:

It’s important to note that while youX takes significant measures to secure data, it’s also essential for your business to follow best practices in data protection. This includes implementing secure access controls, user authentication measures, and internal data security protocols.

SUCCESS (GURUS) BUILT IN

youX strongly believes that onboarding is just the start of the journey and provides comprehensive support and assistance not just throughout the onboarding and implementation, but also ongoing aftercare stages. And it all starts and ends with youXLodge, your Success Gurus. Here’s an overview of some of the support services you can expect:

youX is dedicated to providing comprehensive support and assistance throughout the entire journey, from onboarding to ongoing usage. With Lodge Success Gurus at your disposal to ensure full value realisation across technology products and asset finance fulfilment.

TAILORED PRODUCTS, WITH TAILORED PRICING

Speak to youX today to discuss your specific requirements, and we’ll recommend a product stack that meets your commercial objectives, with a pricing structure to match the recommendation.

Pricing details may vary depending on factors such as the scope of services, customisation requirements, and the specific needs of your business.

SELL MORE, REDUCE THE COST TO SERVICE YOUR CUSTOMERS

youX delivers powerful asset finance technology and fulfilment products designed for lender business growth. Partnering with Australia’s biggest, best and most forward thinking lenders. The youX product stack is flexibly built and seamlessly connected to help your business with a range of commercial objectives, including, but not limited to:

Overall, youX technology and fulfilment products empower lenders to streamline operations, increase lead generation, improve credit decisioning, reduce costs, expand their market reach, mitigate risks, and enhance the customer experience. These benefits contribute to improved efficiency, profitability, and competitiveness in the asset finance industry.

DIVERSE ASSET TYPES & LENDING PANEL

youX products support a truly comprehensive range of asset finance options, so whatever assets our partners need to finance, youX has them and their customers covered:

youX products also support a diverse lending panel. Which means our partners can easily find the right loan for their needs, whether they’re online, on the phone or in their.

And whenever they need extra help, youXLodge Success Gurus are on hand. From in-depth asset finance scenario support to simply covering any lender accreditations they don’t have, drawing on youX’s 80+ lenders. Making it easier than ever to find finance a home.

SEAMLESSLY CONNECTED, AGNOSTICALLY FLEXIBLE

youX technology products are designed to be seamlessly connected, yet agnostically flexible, allowing for compatibility with almost any existing systems and infrastructure.

We recommend discussing your specific requirements and infrastructure with us during the initial requirements discussion. This will allow us to provide the right solution and compatibility guidance.

BRANDSAFE PARTNER PROMISE

youX places a strong emphasis on data security and ensures that the data and information processed through their products are protected, including but not limited to:

It’s important to note that while youX takes significant measures to secure data, it’s also essential for your business to follow best practices in data protection. This includes implementing secure access controls, user authentication measures, and internal data security protocols.

SUCCESS (GURUS) BUILT IN

youX strongly believes that onboarding is just the start of the journey and provides comprehensive support and assistance not just throughout the onboarding and implementation, but also ongoing aftercare stages. And it all starts and ends with youXLodge, your Success Gurus. Here’s an overview of some of the support services you can expect:

youX is dedicated to providing comprehensive support and assistance throughout the entire journey, from onboarding to ongoing usage. With Lodge Success Gurus at your disposal to ensure full value realisation across technology products and asset finance fulfilment.

TAILORED PRODUCTS, WITH TAILORED PRICING

Speak to youX today to discuss your specific requirements, and we’ll recommend a product stack that meets your commercial objectives, with a pricing structure to match the recommendation.

Pricing details may vary depending on factors such as the scope of services, customisation requirements, and the specific needs of your business.

POWERFUL PRODUCTS FOR FASTER, EASIER MORE ACCURATE ASSET FINANCE

youX helps OEM manufacturers, dealers, brokers and lenders to deliver better customer experiences through asset finance technology and fulfilment products. If you’ve found youX, it’s likely that you’ve come through via one of our partners.

Should you need any further help, you can speak to the original partner for more information or contact youXLodge and we’ll help you find a partner to speak to.

TRUSTED BY THOUSANDS WITH BILLIONS

Safety and security is a core youX value and our ‘closed loop’ promise is as much about data security, as it is the youX way of doing business. Inspiring our 11,500+ dealer and broker users, along with 80+ accredited lenders to trust us with $7.4 Billion of finance opportunities every single year.

Below are just a few of the things youX does to keep your data safe, secure and complaint:

Should you need any further help, you can speak to the original partner for more information or contact youXLodge and we’ll help you find a partner to speak to.

DIVERSE ASSET TYPES & LENDING PANEL

youX supports a comprehensive range of asset finance options, including:

Should you need any further help, you can speak to the original partner for more information or contact youXLodge and we’ll help you find a partner to speak to.

CLICK GET QUOTE NOW TO GET STARTED

Simply click “Get Quote Now” to get started. Then follow the super simple questions to begin entering your details. You’ll then be auto-matched with Australia’s largest lender panel to get live personalised quotes with suitable lenders, automatically checking your details against the lenders’ unique lending policies.

A FEW MINS FROM BEGINNING TO END

The application process has been designed to be as quick and easy as possible. From start, through auto-lender-matching, fast finance pre-approval, to submission of a full finance application directly to participating lenders, the whole process just takes a couple of minutes.

youX APPLICATION IS CREDIT FILE SAFE

youX makes it easy for you to auto-match with suitable lenders and gain a finance pre-approval without it leaving a mark on your credit file or affecting your score. You’re then able to go on to submit a full finance application directly to a lender.

Once a fully completed application has been submitted to a lender, the lender will need to run a full credit report. This, as with any full finance application to a lender, could affect your score if your finance application is unsuccessful.

A FEW KEY DOCUMENTS

youX does everything it can to make life easier for you. Having your driving licence handy will save you time, as the OCR document scanning technology uses your driving licence details, instead of having to enter the information by hand.

Once you’ve been auto-matched to your most suitable lender, there may be some additional documents like payslips that the lender needs to process your application. You can upload these straight away or log back in later when you have them to hand.

WE’LL HELP YOU UNDERSTAND YOUR CREDIT SCORE

When youX auto-matches you with suitable lender’s, all the information you provide is being checked, such as, the asset being purchased, housing status, previous loan defaults, employment stability, your credit score and more – to not only check for eligibility, but also the type of rates you might be able to access. While there are a number of factors, it’s important to try to keep a strong credit score to access the best finance products and rates.

It’s also good to know that from lender to lender their customer preferences change, which is why it’s so important for us to have Australia’s largest lender panel. To give you the best chance of finding the most suitable funding.

LARGER DEPOSITS INCREASE CHANCE OF APPROVAL

Yes. You can absolutely add a deposit. In fact, adding a 10 or 20% deposit could give you access to more lenders, reduce your interest rates, improve your chance of approval and even reduce your repayment amount. Should you struggle with matching with suitable lenders, try increasing your deposit amount.

YOU’LL RECEIVE A CALL

Once your finance application has been fully completed, one of two things will happen. If your finance application has been successfully completed to go directly to your matched lender, then the lender will reach out to check things with you before formally assessing your applications for an unconditional approval. If your application needs some extra info before it can go to a lender, then the dealer or broker will reach out to you, depending on where you started your finance journey. Either way, you can expect a phone call to catch up. If you have any questions at any point, you can speak to the original partner for more information or contact youXLodge.

NO HIDDEN FEES

Absolutely not, the rates you see are the rates you’ll pay. While lenders typically do have some fees and charges with their finance products, youX makes sure they’re all wrapped up into the quoted interest rates and payments. So you can rest assured that there’ll be no surprises.

THE SELLER RECEIVES THE FUNDS

After your matched lender has given your asset finance application unconditional approval, the dealer or private seller will be contacted to submit a sales invoice. Once this is received and you have signed your loan paperwork, the funds are transferred to the dealer or private seller. When they have confirmed receipt of the funds you can then pick up your new purchase.

LARGEST LENDING PANEL IN AUSTRALIA

youX maintains the largest lender panel in Australia, with over 90 lenders and growing. Giving you the best chance of finding the most suitable loan for your individual needs. And with such a large lender panel, it means you’ll never need to look anywhere else for your finance. Saving you time and hassle in the process.

PARTNERS PAY youX TO USE OUR PRODUCTS

youX receives payment from its partners, for providing the use of the technology. Partners may also refer finance applications to the youXLodge Success Gurus, to handle the application process for them. In this instance Lodge would likely receive a commission for successfully handling customers on their partners’ behalf. This is all arranged between the lender and Lodge.

MANY FACTORS GO INTO DECIDING RATES

Lenders look at many different variables, such as, the asset being purchased, housing status, previous loan defaults, employment stability, your credit score and more – to not only check for eligibility, but also the type of rates you might be able to access. While there are a number of factors, it’s important to try to keep a strong credit score to access the best finance products and rates.

It’s also good to know that from lender to lender their customer preferences change, which is why it’s so important for us to have Australia’s largest lender panel. To give you the best chance of finding the most suitable funding.