Get Fast,

Easy Finance

Welcome to self-service finance pre-approvals

Matching you to your most suitable lenders, with personalised quotes, showing your weekly repayments and rates. Once you’ve selected your preferred lending option, you can even complete a full finance application, right here. No need to go anywhere else.

Easy application

No hidden fees

Credit score safe*

*Credit score safe for finance pre-approval. Once an application is sent to a lender, a full credit check may take place.

Easy, Fast and Accurate Finance

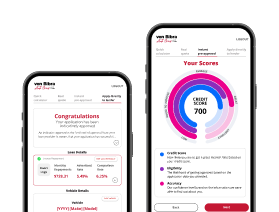

Simply self-serve your own finance in 4 easy steps

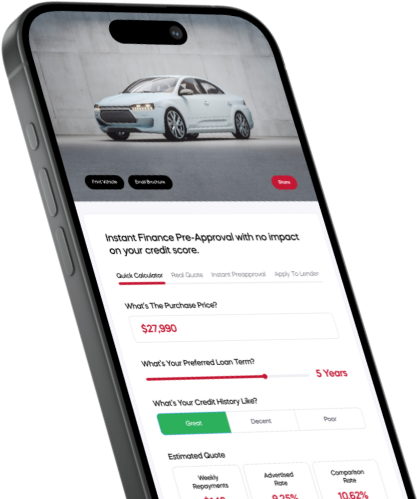

Step 01

Quick Calculator

Instantly calculate your loan options with our smart online calculator

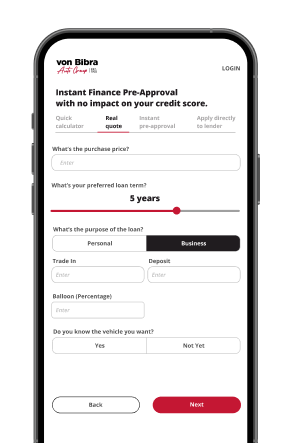

Step 02

Real Quote

Instant Finance Pre-Approval with no impact on your credit score.

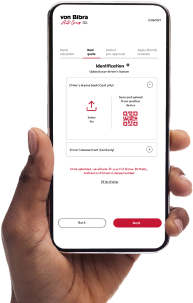

Step 03

Instant Pre-Approval

Our powerful lender matching engine will match you with suitable lenders with 95% accuracy.

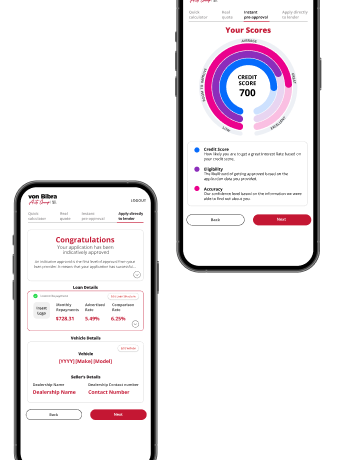

Step 04

Apply to Lender

The fastest ever finance experience! Von Bibra's Quick Apply supports direct-to-lender submissions

Consumer Loans

- The ideal choice for vehicles predominately for personal or domestic use.

- A personally tailored loan with a choice of a one to seven-year term.

- Fixed repayments for the agreed term of the loan, protecting you from repayment increases in a changing interest rate environment.

- Convenience of paying your loan either weekly, fortnightly or monthly.

Commercial Loans

- An asset loan is designed to provide flexibility for people in business while the vehicle remains an asset of the business.

- Offers the certainty of a fixed interest rate, over a choice of terms from one to five years.

- Convenience of paying your loan either weekly, fortnightly or monthly.

- Ability to reduce the amount financed through trade-in and/or cash deposit options.

Why use our finance?

No need to wait or save

You can often borrow the full purchase price of the vehicle, with no or little deposit. So you could be holding your new keys, as soon as the finance is ready to go, in a matter of days.

Get the car you really want

Spreading your payments over a period of time, instead of a single cash sum, may allow you to get the car you really want, instead of another that you only half want. And if you’d like to reduce your monthly repayments, you could consider increasing the loan payment term.

Improve your credit rating

We help you find a lender that suits your needs and financial situation. So once you’ve bought a vehicle on finance and assuming you continue to fulfil your repayments on time, your credit score is likely to improve.